Date: 1 May 2024

Timing the equity market with any consistency is notoriously difficult. However, from time to time, trustees can become more concerned about downside risk and wish to explore options for mitigating this.

This concern can come about for a number of reasons:

- Scheme-specific concerns, e.g. an important valuation looming.

- An economic shock bringing about a sell-off of risk assets.

- Concerns over the absolute or relative valuation levels of equity markets.

- Concerns over the broader economy or political uncertainty - this could be general concern or related to specific sectors (e.g. tech “bubbles”), countries, or commodities.

Current market situation

Direct sale

Where there is concern about an equity market sell-off, or where the downside risk of such would be too great for an investor to tolerate, the most basic approach is simply to reduce or remove the allocation to equities.

However, for many longer-term pension scheme investors, the strategic allocation needs to be agreed with a sponsor. Changes to strategic asset allocation targets can impact the discount rates used within the scheme’s technical provisions (“TPs”) liability calculations which in turn are used to determine the required contribution rates, meaning temporary de-risking intended to mitigate specific short-term risk should be carefully implemented to avoid undesired consequences. Meanwhile, other trustees may be comfortable to ride through periods of volatility, with the expectation that it will be rewarded over time. This can also avoid the “regret risk” of missing out on potential upside from holding equity market exposure. The sale of an asset also requires it to be held elsewhere in cash or other assets that keep the total portfolio in line with its objectives. Additionally, subsequent repurchase of the equities sold can have cost implications (including tax, such as stamp duty in the UK).

Diversification

Institutional return-seeking portfolios have generally evolved over time to have less reliance on equity markets as the key driver of returns (and risk). They are also typically more diversified than in previous decades. Property, higher-yielding bonds and a range of alternative investments are often included to reduce overall portfolio volatility whilst seeking to avoid sacrificing too much return. Genuinely “orthogonal” assets, i.e. those with little or no correlation to equities and/or bond and credit markets are often complex and expensive (e.g. catastrophe/weather insurance bonds, or various hedge fund strategies). Portfolio construction can become a trade-off between the need for upside returns, appetite for downside risk, cost and complexity (and therefore governance requirement).

Use of derivatives – Equity protection strategies

One approach available to effectively manage the equity risk within a portfolio is to use derivative instruments. Namely options, to reshape the equity risk, by putting in place contractual downside risk by purchasing put options (the right, without obligation, to sell equities at a certain price at a certain time).

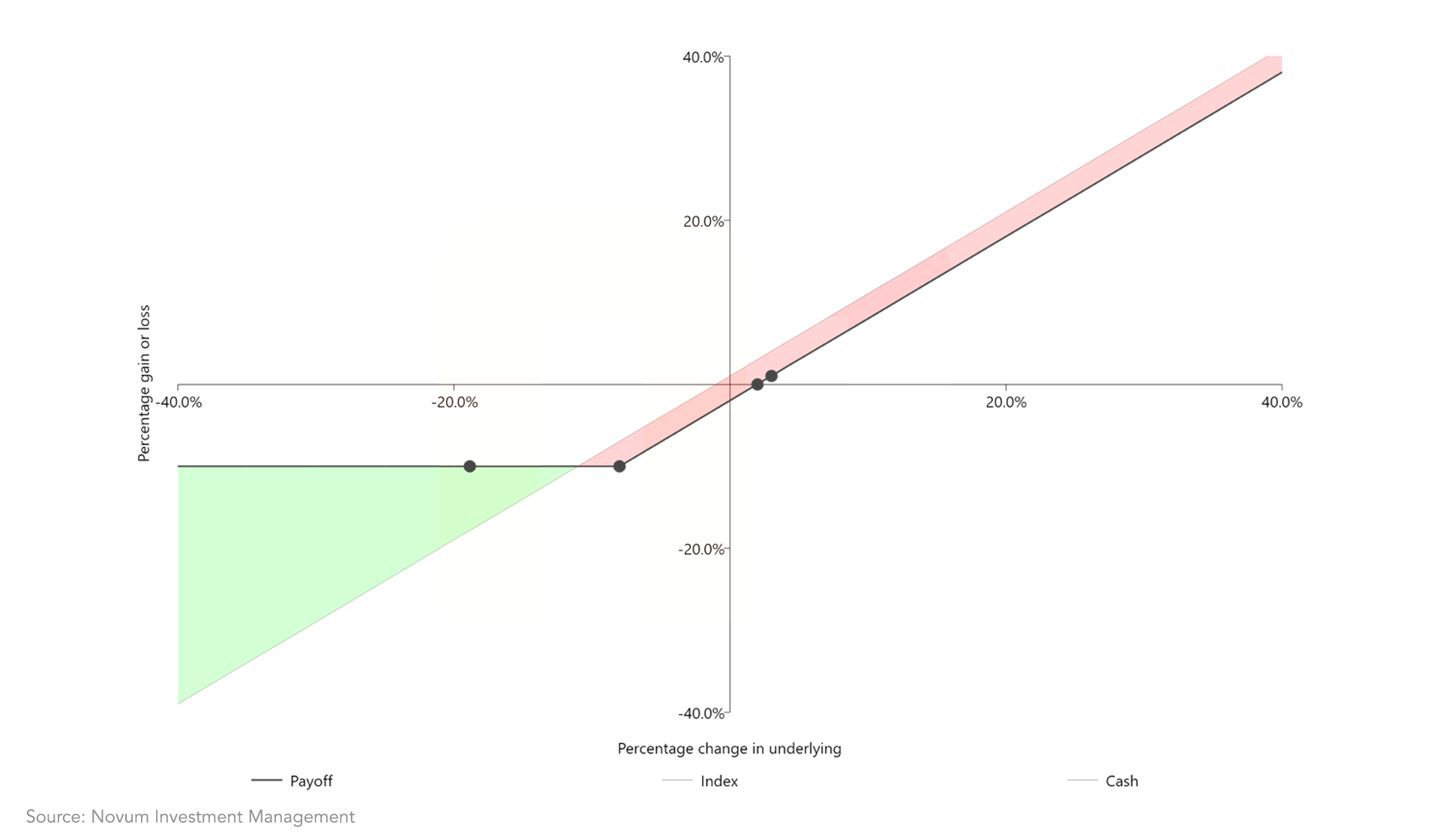

Recent pricing of a put protection strategy with 90% protection (i.e. target maximum loss of 10% on the S&P 500 Index) is shown in the chart below as an example, with a sacrifice of 3-3.5% of nominal exposure. At the end of 2021, before global interest rates started rising, this price was nearer to 6-6.5%. Therefore the price of such protection has reduced materially.

In the example below, a client has protected itself from falls in markets of more than 10% over the next 12 months in return for worse off by 3% in all other scenarios. The green areas show where the client is better off (protection) while the red areas show the scenarios where it pays for this (cost).

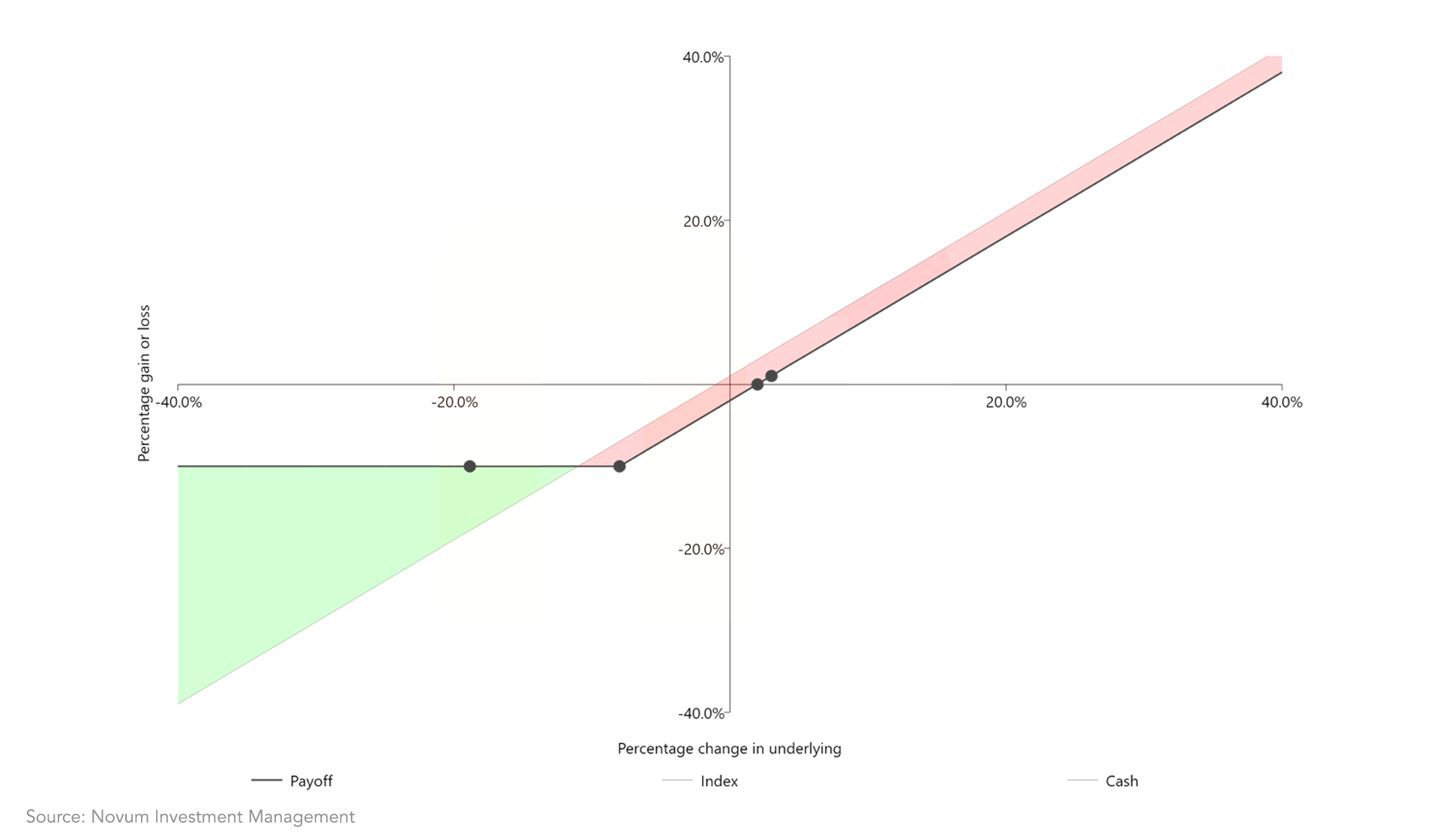

If this cost is considered too great, strategies can be designed that are cost neutral in a wider range of outcomes. This is enabled by selling upside in equity markets beyond a certain level (by selling call options and receiving a premium, which covers the cost of the downside-protecting put option). An example of this is shown below. In this example protection is effected for market falls between 10% and 25% (green area) with no cost for any scenarios except where the market rises by more than 18.5%.

In summary, pension schemes and other equity investors can use this toolkit of options to reshape equity risk, on a potentially cost-neutral basis, to better reflect their specific risk appetite, current situation, or downside concerns. The specifics of how to implement will depend on a client’s particular situation and objectives.

Summary

We think that now is an appropriate time for investors to consider their risk appetite and specifically the nature of their prevailing equity risk exposures. In consideration of investors’ views on the various risks currently manifest in the market, it could be that a degree of protection might be advantageous.

In particular, the use of derivatives-based equity protection strategies, as described above, could be worth exploring further. We are able to help trustees explore cost effective approaches to putting such strategies inplace for schemes of any size.

If you would like to discuss any of these matters further, please get in touch with your usual contact at Cartwright.